What is the reverse rule of 78s?

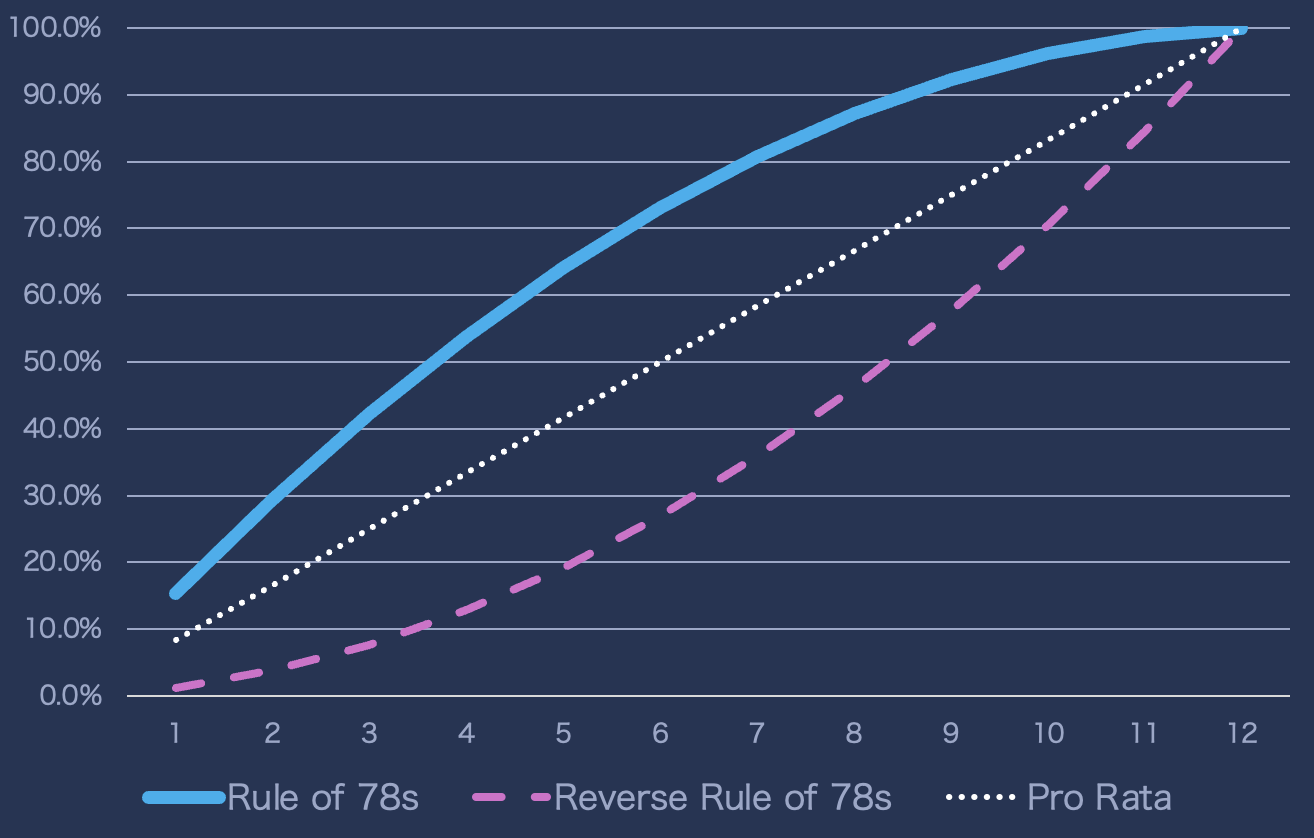

The Reverse Rule of 78s is a revenue recognition method that back-loads the earnings curve—recognizing less revenue in the early months of a contract and more in the later months. It uses the same weighted formula as the traditional Rule of 78s but flips the order, assigning higher earnings to later periods.

Unlike Pro Rata, which spreads revenue evenly, or the standard Rule of 78s, which front-loads it, this method delays earnings intentionally. It’s often applied to F&I products sold with new vehicles, especially vehicle service contracts, because losses are minimal in early months due to OEM warranty coverage. This creates a smoother alignment between actual claims risk and earned revenue, particularly when most risk emerges in the back half of the contract term.

How does the reverse rule of 78s work?

For an n-month contract:

- Sum the digits from 1 to n:

Sum = n(n + 1) / 2

- Assign weights in forward order:

- Month 1 = 1

- Month 2 = 2

- …

- Month n = n

- Revenue is earned in proportion to these ascending weights.

Example: 12 month contract

|

Month

|

Weight

|

% of Revenue Earned That Month

|

|---|---|---|

| 1 | 1 | 1.3% |

| 2 | 2 | 2.6% |

| 3 | 3 | 3.8% |

| ... | ... | ... |

| 12 | 12 | 15.4% |

Why Use the Reverse Rule of 78s?

The Reverse Rule of 78s is used to back-load revenue recognition in F&I and warranty products—earning more revenue later in the contract term. Companies often choose this method when they want to:

-

Match revenue to actual claims risk: especially in Vehicle Service Contracts (VSCs), where claims typically rise over time as OEM warranties expire.

-

Delay earnings for conservative revenue recognition or to prevent overstating early profitability.

-

Mimic actuarial earnings patterns when real claims data is limited or actuarial models are too complex.

When is it used?

-

Reinsurance (especially CFCs): Matches cash outflows with revenue recognition more prudently.

-

Insurance-backed Vehicle Service Contract (VSC) programs: Aligns with actual risk exposure and is more GAAP-compliant than the traditional Rule of 78s.

-

Auditor preference: Often more defensible when actuarial claims curves aren’t available or used.

What are the Limitations?

- Lacks actuarial precision: Still an approximation—not as accurate as a data-driven loss emergence or experience curves

- Delays profitability recognition: Heavily back-loaded earnings can reduce early reported revenue, which may impact performance metrics for growth-stage companies or investor reporting.