What is the rule of 78s?

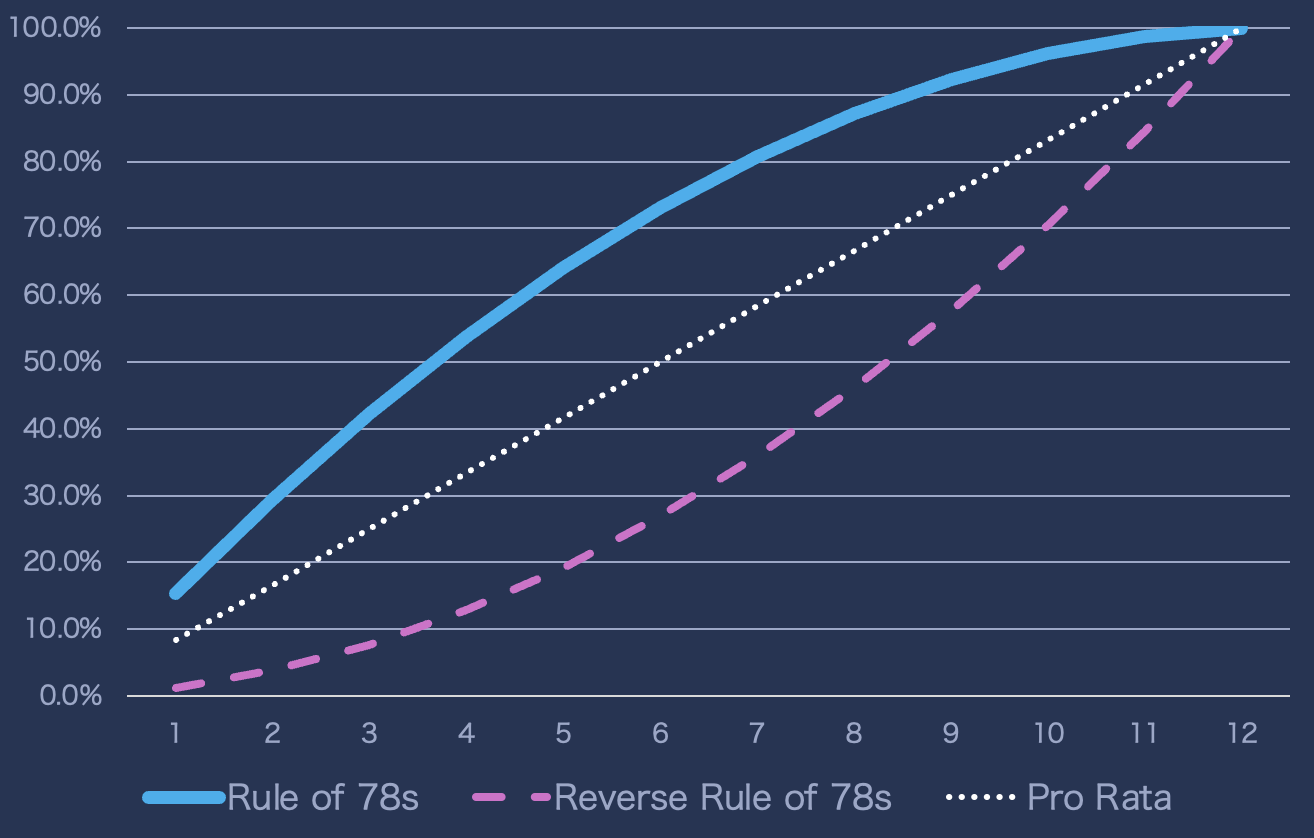

The Rule of 78s is a revenue recognition method used in the F&I industry that front-loads earnings—recognizing more revenue in the early months of a contract and less in the later ones. Unlike the Pro Rata method, which spreads revenue evenly across the contract term, Rule of 78s assigns higher earnings to earlier periods based on a declining weight system. This approach results in faster recognition of revenue, especially in the first half of the contract, and is often used for vehicle service contracts and other F&I products when early profitability is prioritized.

How does the rule of 78s work?

The “78” in the name comes from the sum of the digits 1 through 12 (1+2+3+…+12 = 78), used for a 12-month contract. For an n-month contract, the sum of digits is:

Sum = n(n+1)/2

Each month is assigned a weight in reverse order — the first month has the highest weight, the last month has the lowest. Revenue is earned proportionally to these weights.

Example: 12 month contract

|

Month

|

Weight

|

% of Revenue Earned That Month

|

|---|---|---|

| 1 | 12 | 12/78 = 15.4% |

| 2 | 11 | 11/78 = 14.1% |

| 3 | 10 | 12.8% |

| ... | ... | ... |

| 12 | 1 | 1.3% |

Why Use the Rule of 78s?

-

Maximizes early earnings: This earnings curve recognizes more revenue in the first months of the contract, which improves short-term profitability for dealers and administrators.

-

Aligns with early-term cancellations: Many F&I and warranty products—like VSCs, home warranties, appearance protection, and tire & wheel—experience the highest cancellation rates early in the contract.

-

Provides a consistent revenue pattern: The rule applies a fixed, predictable schedule, making it easier to track earnings over time—even if it doesn’t match actual claims behavior.

What are the downsides to using the Rule of 78s?

-

Doesn’t reflect actual claims risk: Unlike actuarial or experience-based curves, the Rule of 78s assumes a fixed pattern and fails to account for the fact that claims often increase as contracts age.

-

Not compliant with GAAP for insurers: This method is typically not accepted under statutory or GAAP accounting standards for admitted insurance carriers.

-

Overstates early revenue and profitability: By front-loading earnings, it can distort financial performance—especially in reinsurance structures or compensation plans tied to early-term margins.

When is the Rule of 78s used?

- Dealer is obligor (vs. insurance-backed)

- Simplicity is preferred over accuracy

- Shorter-term contracts dominate

- No regulatory pressure for actuarial earnings