Balance Curves

Track how balances shift over time—by contract, loan, policy, or client account—with the Balance Curve Analytics Tool.

This tool transforms raw data into clear, time-aligned visuals that reveal how value moves across a cohort—month by month. Whether you’re tracking balance decline (paydown) or accumulation (build), each record is aligned from Month 1 forward based on origination.

Use the Balance Curve Analytics Tool to:

-

Monitor loan paydown by vintage

-

Analyze client AUM growth across segments

-

Evaluate deposit inflows or recurring revenue behavior

-

Benchmark performance across terms, geographies, or customer types

There’s no modeling required—just upload your Excel file and go. No code. No complex setup. Just insight.

Your data stays private. Files are processed in-session only and permanently deleted after each use.

Use Cases

Lender analytics tools

Visualize how balances pay down over time—by product, origination month, credit tier, or vendor. Spot slow-paying cohorts and repayment anomalies instantly.

Benefits

TIME

Build a Balance Curve with filters in under 60 seconds

Skip the 10+ hours it takes to do it manually in Excel

ACCURACY

Remove human error with automated calculations

Trust every curve—logic is transparent and repeatable

FLEXIBILITY

Filter on any field in your dataset

Works with your structure—no need to reformat files

How It Works

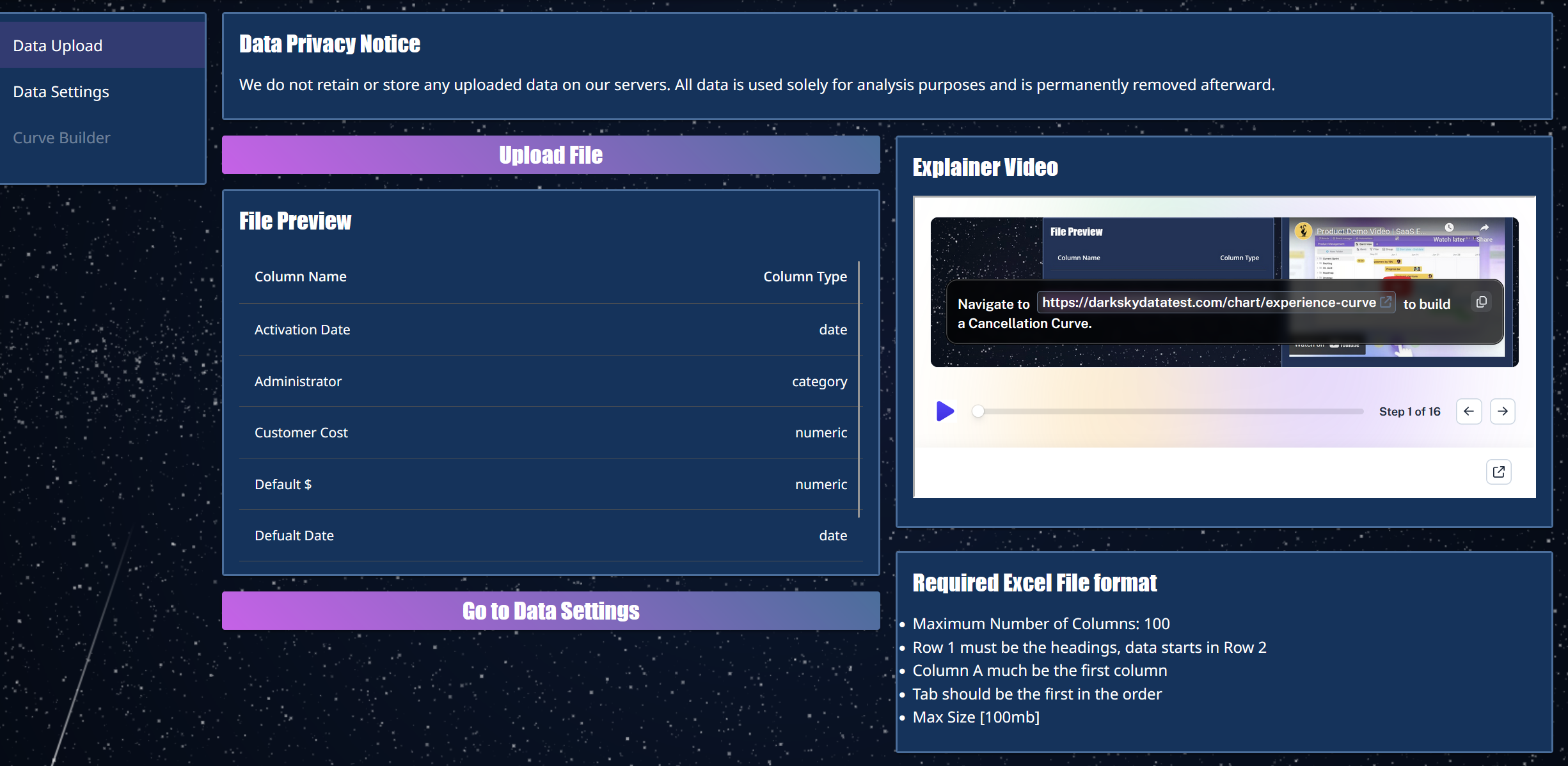

Step 1: Upload

Drop in your Excel —no formatting required.

Big files? No problem. Just make sure the data is in the first tab.

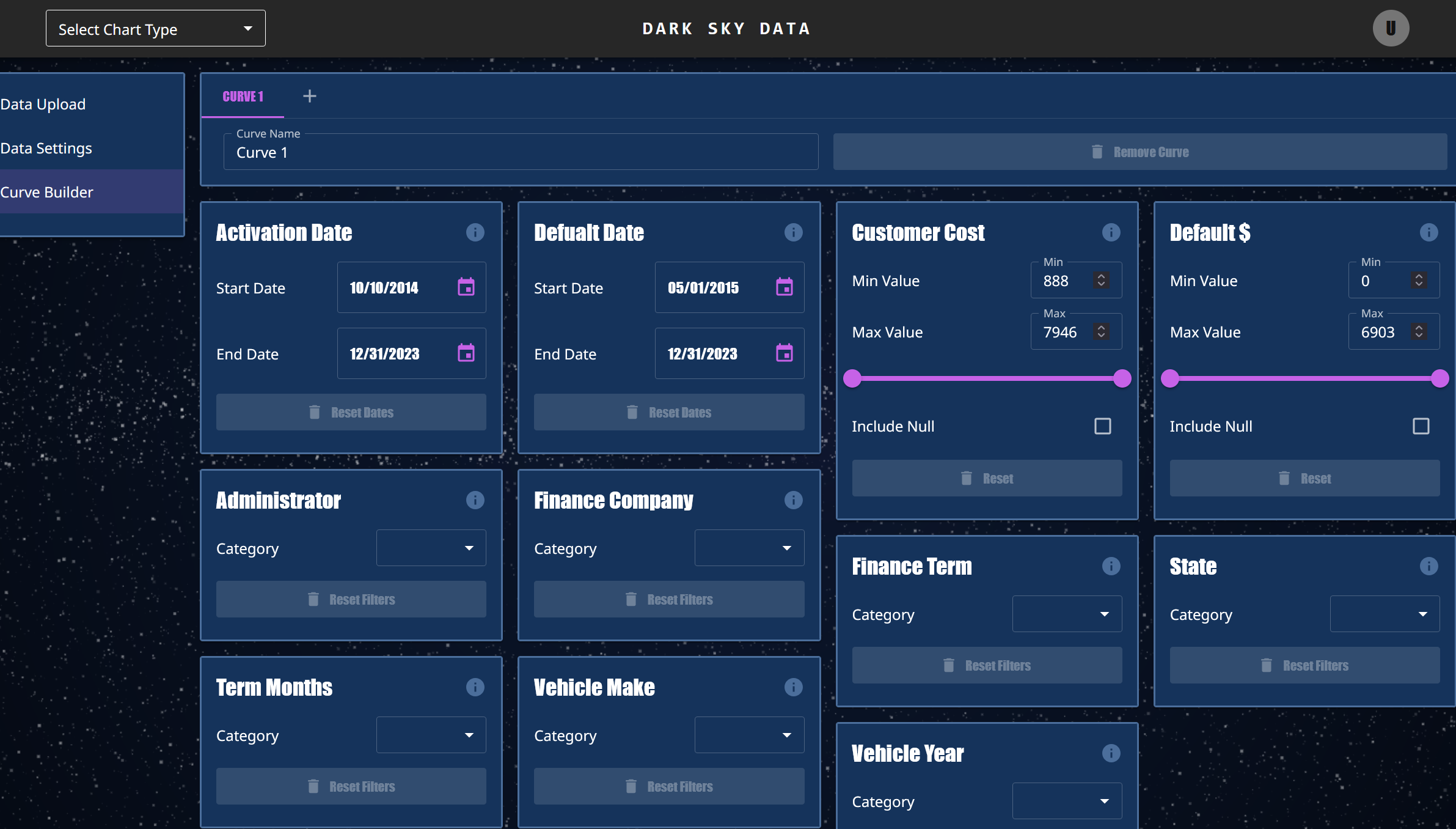

Step 2: SET FIELDS AND FILTERS

Turn any column into a filter.

Compare paydown curves by channel, state, product—even 18 month loans by interest rate in Texas.

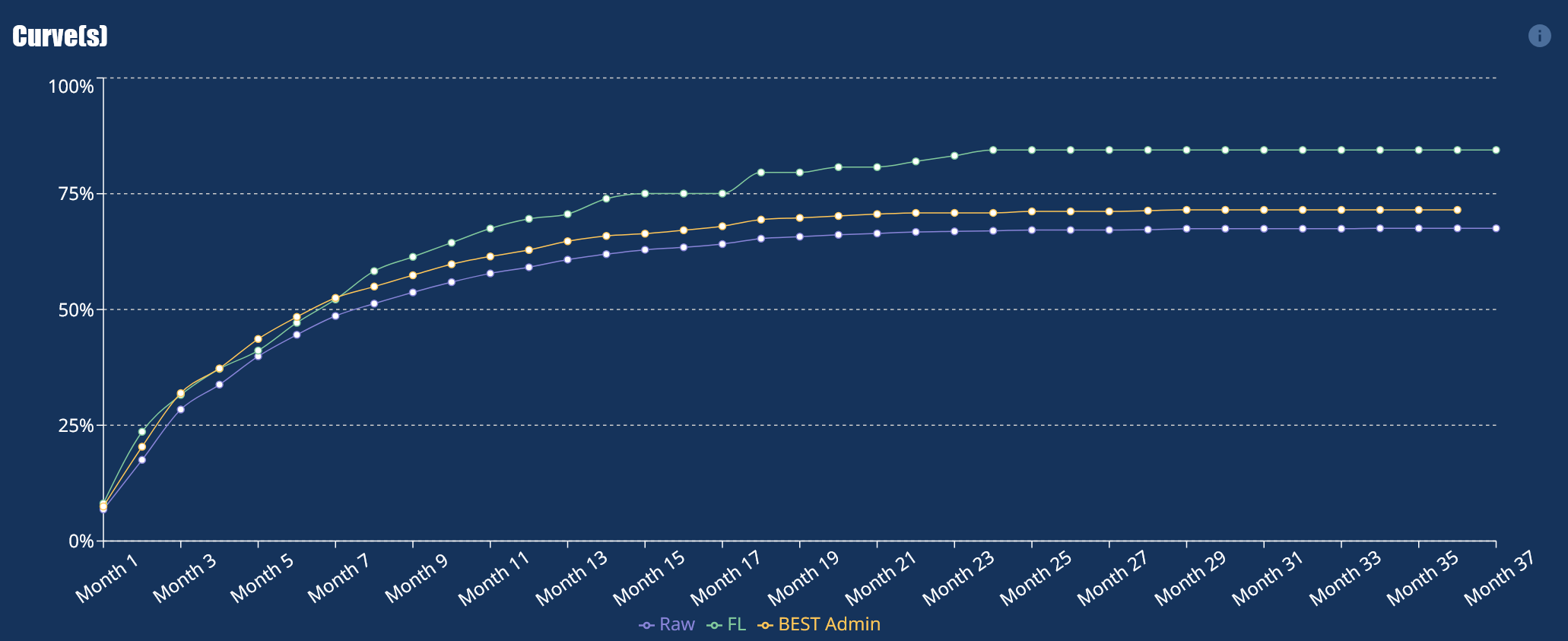

Step 3: Build Curves

Step 3: Build Curves

The curve builds itself—automatically and instantly.

Hover to reveal exact values with interactive tooltips.

Compare up to five filtered curves side-by-side, ready to explore or export.