What earnings curves are used in the F&I industry?

An earnings curve determines how revenue is recognized over time for an F&I contracts, such as VSCs, windshield, PDR, appearance protection, and tire & wheel. The method you choose directly affects reported loss ratios, reserving, valuation, and timing of earnings and cash flow. The four most common earnings curve methodologies are:

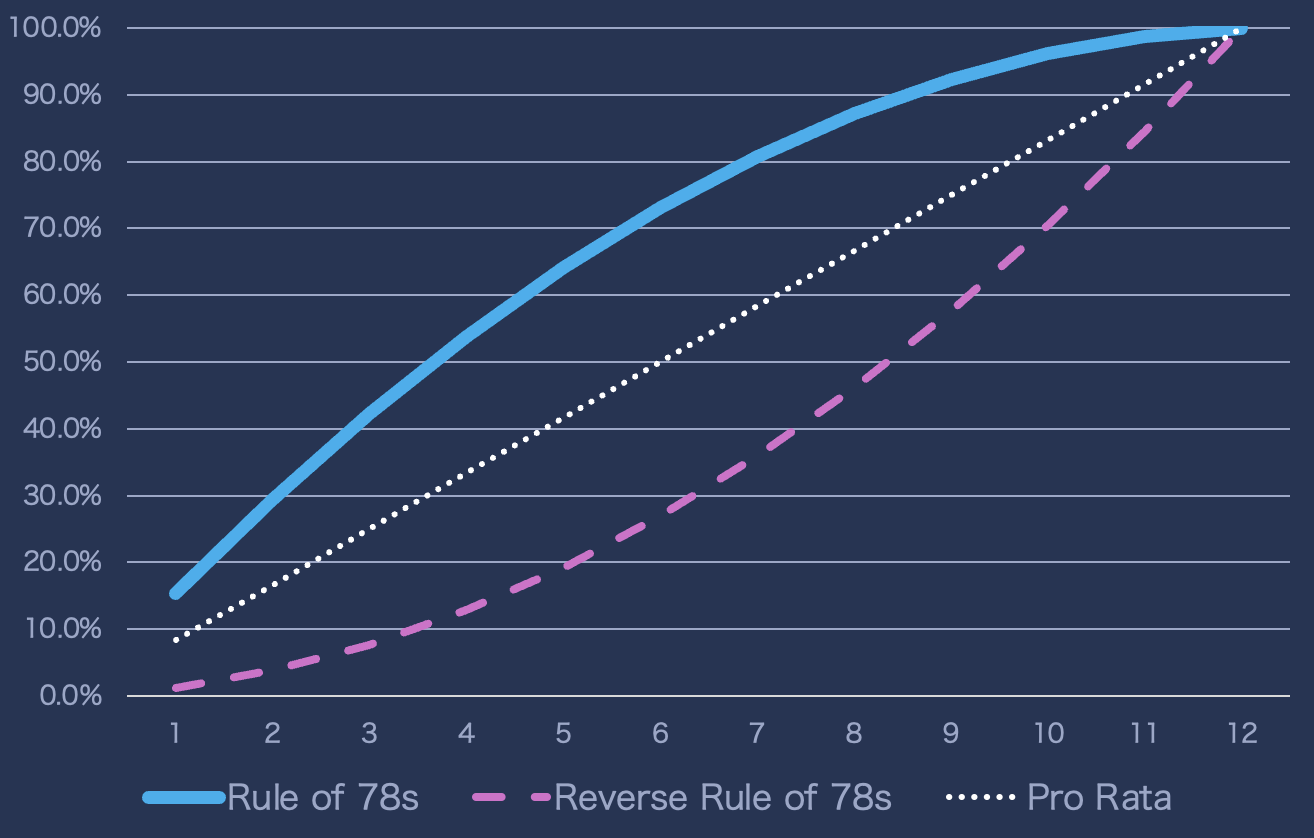

- Rule of 78s

- Reverse rule of 78s

- Pro rata

- Experience based

Below is guidance on when and why each is used.

|

Month

|

Rule of

78s Weight

|

Rule of

78s %

|

Reverse Rule of

78s Weight

|

Reverse Rule

of 78s %

|

Pro Rata

%

|

|---|---|---|---|---|---|

| 1 | 12 | 15.38% | 1 | 1.28% | 8.33% |

| 2 | 11 | 14.10% | 2 | 2.56% | 8.33% |

| 3 | 10 | 12.82% | 3 | 3.85% | 8.33% |

| 4 | 9 | 11.54% | 4 | 5.13% | 8.33% |

| 5 | 8 | 10.26% | 5 | 6.41% | 8.33% |

| 6 | 7 | 8.97% | 6 | 7.69% | 8.33% |

| 7 | 6 | 7.69% | 7 | 8.97% | 8.33% |

| 8 | 5 | 6.41% | 8 | 10.26% | 8.33% |

| 9 | 4 | 5.13% | 9 | 11.54% | 8.33% |

| 10 | 3 | 3.85% | 10 | 12.82% | 8.33% |

| 11 | 2 | 2.56% | 11 | 14.10% | 8.33% |

| 12 | 1 | 1.28% | 12 | 15.38% | 8.33% |

1. What is the Pro-Rata (Straight-Line) earnings method?

Short Answer: Pro-Rata earns revenue evenly over the life of a contract, regardless of claim activity.

When it’s used: By administrators or insurers seeking a simple, conservative method.

Benefits:

- Very easy to implement and audit

- Matches time-based exposure, not actual claims

Downsides:

- Misaligns with real-world claims, which often occur earlier in the contract

2. What is the Rule of 78s earnings method?

Short Answer: The Rule of 78s front-loads revenue, recognizing more in early months and less later.

When it’s used: Dealer-obligor programs, reinsurance structures, or when early cancellation risk is high.

Benefits:

- Matches common refund patterns (heavier early cancellations)

- Can front-load profit for early cash return

Downsides:

- Overstates profitability early

- Doesn’t reflect true claims exposure over time

3. What is the Reverse Rule of 78s method?

Short Answer: Reverse Rule of 78s back-loads earnings to match rising claims frequency over time.

When it’s used: New vehicle sales because the OEM warranty covers losses and in programs with higher claims toward the end (e.g., high-mileage or long-term VSCs).

Benefits:

- Matches actual claims emergence

- Helps present a more accurate loss ratio profile

Downsides:

- Suppresses early earnings

- May delay reported profitability

4. What is a Claims-Based or Experience Curve?

Short Answer: A claims-based curve uses historical data to match earnings to actual loss patterns.

When it’s used: By large administrators, MGAs, or insurers with the data and tools to model loss cost accurately.

Benefits:

- Most accurate method for loss ratios and reserving

- Compliant with GAAP and preferred by auditors

Downsides:

- Requires significant historical data

- More complex to build and maintain

At Dark Sky Data, we offer custom-built Experience Curves based on your real-world claims history—by product type, region, and cohort.

Summary: Which earnings curve is right for you?

|

Method

|

Best for

|

Pros

|

Cons

|

|---|---|---|---|

| Pro-Rata | Simplicity & conservative filings | Easy to apply; matches time, not claims | Doesn’t reflect actual claim activity |

| Rule of 78s | Dealer-obligor or early refunds | Matches cancellations; accelerates earnings | Front-loads revenue; mismatches claims |

| Reverse Rule of 78s | Back-loaded risk profiles | Reflects delayed claims emergence | Delays early earnings |

| Experience / Claims-Based | Accurate loss ratios & valuation | Data-driven and audit-ready | Requires modeling and historical data |

| Want help selecting or modeling your earnings curve? Dark Sky Data makes it easy—just upload your data and we’ll build a claims-aligned curve for you. | |||