F&I Trends Q2 2025: Profit Resilience Amid Tariff Turbulence

Even with tariff headlines and affordability concerns, F&I performance stayed solid in Q2 2025. Dealers continued to capture profit per vehicle, consumers leaned harder into protection products, and the underlying vehicle mix shifted in ways that will shape the next 12 months of opportunity.

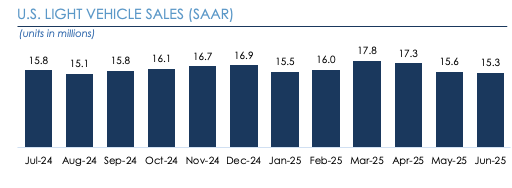

Sales Momentum Holds Despite Tariff Headwinds

U.S. new-light-vehicle sales averaged 16.1 million SAAR in the second quarter—up 2.9% year-over-year.

April alone topped 17 million units as buyers rushed to purchase ahead of expected tariff-related price increases. While sales eased in May and June, OEMs are expected to counterbalance with new incentives if tariffs weigh on affordability.

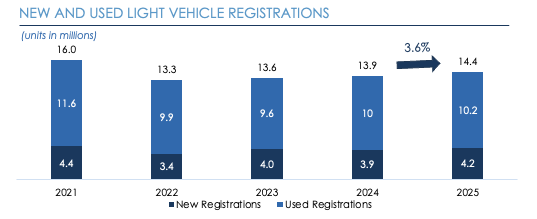

Registrations Rise—Led by New-Vehicle Strength

Total vehicle registrations grew 3.6% year-over-year. New-vehicle registrations climbed 7.7%, while used-vehicle titles grew 2.0%. Consumers are still choosing new when possible, supported by stable credit and incentive activity.

The takeaway: demand remains healthy even in a price-sensitive environment.

The F&I “Sweet Spot” Narrows, but the Opportunity Deepens

Vehicles aged 6 to 12 years—the industry’s F&I sweet spot—accounted for 35.5% of total vehicles in operation, down from 36.5% a year earlier.

That decline traces back to the pandemic-era production gaps of 2020, meaning fewer vehicles are now aging into the ideal F&I window. As newer vintages catch up, this temporary compression will correct, and pent-up demand for protection coverage will expand.

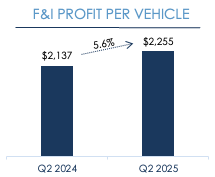

F&I Remains the Dealer Profit Engine

Among the six largest public dealer groups, same-store F&I profit per vehicle retailed (PVR) averaged $2,255, a 5.6% increase from Q2 2024.

Penetration of Vehicle Service Contracts (VSCs) and GAP coverage remained strong as buyers sought protection from volatile repair costs and high ownership expenses. Even as new-vehicle margins compressed, F&I income continued to carry dealership profitability.

Affordability Pressures Are Reinforcing F&I Demand

Several forces are working in parallel:

- Tariffs are raising repair costs along with vehicle prices, heightening consumers’ need for predictable ownership expenses.

- Loan-to-value ratios are edging lower even as average loan amounts rise—evidence of strong credit quality and disciplined lending.

- Ownership cycles are lengthening, extending exposure to post-warranty repairs.

- Protection products have become budget tools, not just add-ons—helping consumers stabilize monthly costs and avoid major repair shocks.

Together, these dynamics are reframing F&I not as a back-end sale, but as a core component of vehicle affordability.

What to Watch Next

The next few quarters will test how tariffs influence retail pricing and how dealers adapt incentives to sustain volume. But one theme is clear: F&I profitability is durable.

Dealers that treat protection products as financial planning tools for consumers—rather than discretionary upsells—will maintain both customer loyalty and margin stability.

For the complete set of data and charts and to see recent M&A in the F&I industry, download the Q2 2025 F&I Quarterly Update from Colonnade Advisors at https://coladv.com/quarterly-updates-archive/**.**