April 2025 Home Sales: Inventory Rises, but Buyers Stay Cautious

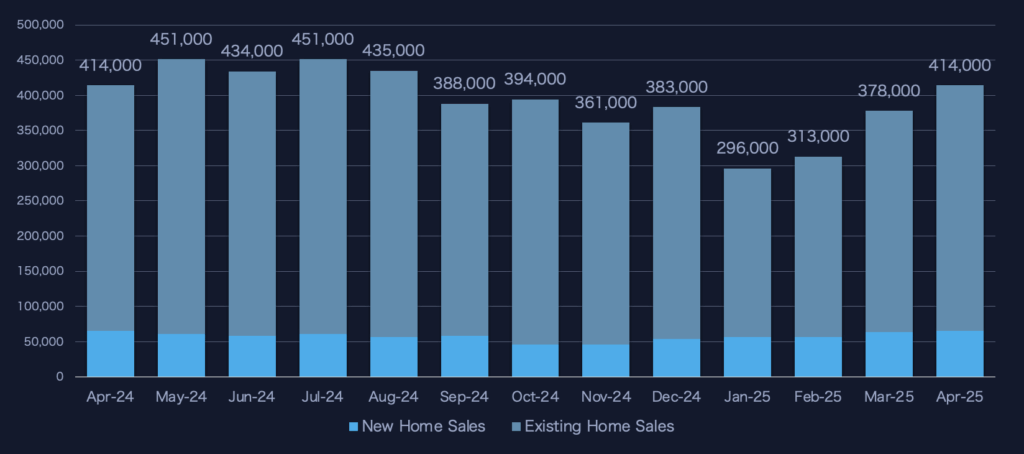

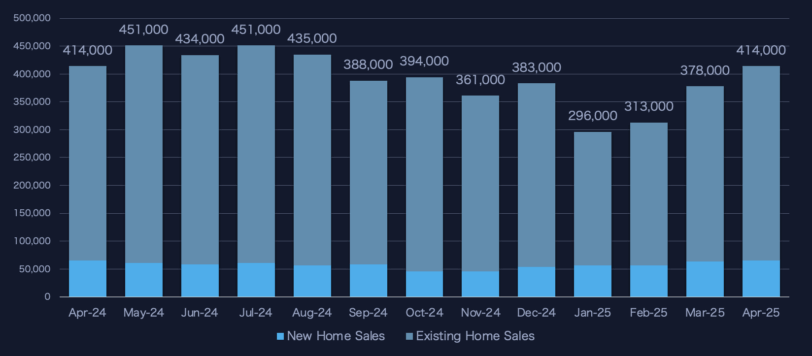

Home sales climbed in April—but momentum is still hard to come by. New construction helped lift total volume, while existing home sales ticked up seasonally. Yet under the surface, familiar constraints continue to shape the market: high mortgage rates, weak affordability, and a growing disconnect between buyers and sellers.

Across both segments, inventory is rising. But that doesn’t mean confidence is. Builders are doing the heavy lifting. The resale market, still locked in by low-rate owners and affordability ceilings, is expanding in listings—but not in transactions.

New Construction Keeps Carrying the Market

New home sales are doing what existing homes can’t: moving. Builders continue to offer the right mix of price points, incentives, and flexibility—and buyers are responding. In April, new single-family home sales rose 10.9% from March, and 3.3% year over year.

This is now a consistent theme. Builders have adapted to the high-rate environment in ways the resale market cannot. They’re shifting product toward sub-$400K homes, offering rate buydowns, and financing closing costs to help offset affordability concerns.

The result? The strongest pace of new home sales since early 2023—and a market that, while not booming, is at least functioning.

Existing Home Sales: Up, But Not Out

Existing home transactions rose from March, but the year-over-year story remains flat. Seasonally adjusted sales were down 2% from April 2024, despite improved inventory.

The culprit? Still mortgage rates. Still lock-in. Still affordability.

While inventory increased in April, most of that came from homes sitting longer—not from a wave of new sellers. The average 30-year rate held in the 6.7% to 6.8% range, and that’s still too high for most current owners to consider listing. There’s plenty of shopper interest, but few shoppers who can act.

Days on market ticked up in several metros. Sellers who listed high in March are beginning to drop prices, but not fast enough to unlock volume.

Rates Haven’t Moved, So the Market Can’t Either

Mortgage rates continue to be the central governor on housing activity. At nearly 7%, they constrain both sides of the market: buyers can’t stretch, and sellers won’t budge.

Even slight movements down—say to 6.25%—could free up some demand. But we’re not there yet. As long as rates hover where they are, this pattern will persist: strong-ish new construction, sluggish resales, and regional markets defined more by policy and insurance than pure demand.

Inventory’s Up. That’s Not Always Good News.

April brought more listings across most markets—but the story behind those listings matters.

In the new home segment, inventory growth is strategic. Builders are releasing new phases, pre-listing under-construction homes, and maintaining momentum. This is productive supply. It gives buyers options and helps stabilize prices.

In the existing home market, however, rising inventory is more a symptom than a solution. Listings are building up not because owners are returning, but because buyers are hesitating. Homes are sitting longer, and pricing strategies haven’t caught up to buyer budgets.

One market is pushing. The other is stalling.

Regional Recap: Where Activity’s Shifting

Texas

Still dominant, but softening. With nearly 30,000 closings in April, Texas led the nation—but saw a 3.4% drop from the prior year. Builders captured more share, and the entry-level segment is oversupplied in metros like Austin and San Antonio.

Ohio

One of the few bright spots. Volume was up 2.3% YoY, and prices rose 4.4%. Central Ohio inventory jumped 45% from a year ago, but demand kept pace. Momentum is real here.

Illinois

Chicago-area sales dipped 3.4% YoY, even as prices climbed 6.2%. Inventory remains tight, especially in the city core. Buyers want turnkey homes; sellers with dated properties are seeing fewer offers.

Georgia

A rare combination of rising sales and inventory. Volume jumped 10.7%, while listings climbed nearly 40%. More townhomes and condos on the market suggest a shift in product mix. The market is moving and diversifying.

Pennsylvania

A mixed bag. Sales rose 11% from March but were still down YoY. Inventory is up, especially in suburban markets, but Philadelphia volume is lagging. The statewide median price is holding firm, up 7.2%.

California: Still Jammed

California saw a slight seasonal lift in April, but volume remains deeply suppressed. Prices in some inland metros have plateaued, and time on market is stretching out. Affordability is still the main issue—and insurance availability is making things worse.

There’s limited new construction, limited inventory, and limited incentive for owners to move. The market’s stuck in neutral, and nothing in April changed that.

Florida: Growth, With Friction

Florida remains a top-five market by volume, but price momentum is slowing, and insurance costs are cutting into affordability. In some metros, buyers are hitting pause—not because they don’t want to buy, but because total ownership costs have spiraled.

New construction is still moving, especially in central and southwest Florida. But the resale market is showing signs of fatigue, especially in overbuilt coastal zones.

The Bottom Line: More Movement, But Not Yet Momentum

April looked like a turning point—but under the surface, it’s the same playbook. Builders are selling. Existing homes are waiting. Rates are holding the market in a narrow band, and affordability isn’t improving fast enough to break it.

Seasonal trends will continue to push volume higher in May and June—but unless rates fall meaningfully, we’re likely to see more of what we’ve already seen: new homes doing the heavy lifting, and resales stuck in the waiting room.

See how these trends affect warranty sales with our Experience Curve: https://darkskydata.com/who_we_help/vsc-and-home-warranty-marketer-analytics-tools/