Reflecting the most recent U.S. Census Bureau and NAR releases (November 2025) | Published February 2026 November 2025 home sales did not signal a broad housing recovery. They clarified the structure of the market heading into 2026. Buyer demand remained payment-sensitive. Resale turnover remained constrained by homeowner lock-in. Builders continued adapting through pricing flexibility and […]

Reflecting the most recent U.S. Census Bureau release (October 2025) Published January 2026 The U.S. housing market operated under competing constraints in October 2025. Buyer demand remained rate-sensitive and affordability-limited, while resale supply continued to be constrained by homeowner lock-in. Builders, however, adapted more quickly—using pricing flexibility and incentives to sustain transaction flow. October 2025 […]

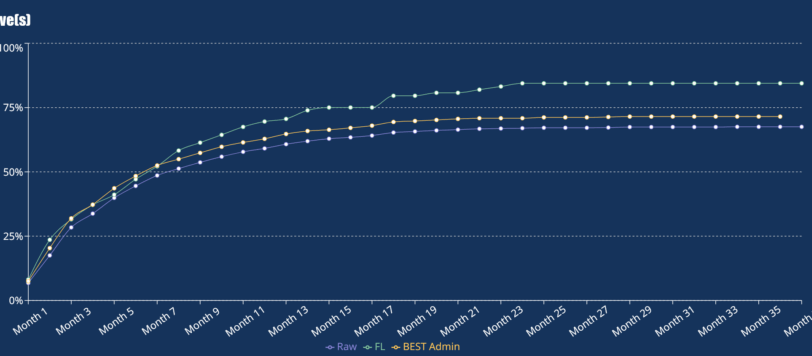

Loss ratios sit at the center of every smart underwriting, pricing, and reinsurance decision. Yet most warranty administrators still calculate them with outdated tools, stale data, or earnings curves that haven’t been questioned in a decade. That combination is dangerous—because when your earnings curve is wrong, everything downstream is wrong too. And the truth is […]

Selling more contracts isn’t the goal. Making more money is. Too many marketers chase top-line volume and ignore the hidden costs eating their margin—cancellations, poor targeting, slow mail, and comp plans that reward the wrong behavior. If you want exponential growth that actually sticks to the bottom line, start here. 1. Study Your Cancellation Curve […]

The Great Standoff: September Housing Data Shows a Market Waiting for a Spark Summary: The fall chill isn’t just in the air—it’s settling into the housing market. September’s data reveals a slow-motion stalemate between buyers and sellers, with builders once again driving what little momentum exists. For home warranty providers, this split market demands precision: […]

Even with tariff headlines and affordability concerns, F&I performance stayed solid in Q2 2025. Dealers continued to capture profit per vehicle, consumers leaned harder into protection products, and the underlying vehicle mix shifted in ways that will shape the next 12 months of opportunity. Sales Momentum Holds Despite Tariff Headwinds U.S. new-light-vehicle sales averaged 16.1 […]

The Great Decoupling: New Homes Surge While Resales Stand Still Summary: The U.S. housing market has split in two. New construction is booming on builder incentives, while resale remains stuck under the weight of the lock‑in effect. For home warranty providers, growth in late 2025 will come from reallocating effort toward where transactions are actually […]

The housing market isn’t crashing—but it is shifting. Slowly. Unevenly. And for home warranty providers, July 2025 offers critical signals about where demand is likely to rise, where lead quality is improving, and where to allocate marketing and service resources next. While national home sales totals held steady compared to June, the underlying details show […]

You Can’t Afford to Guess Most direct-to-consumer marketers in the vehicle service contract (VSC) and home warranty space know their topline numbers. Sales volume. Cancel rate. Cost per lead. But those numbers don’t tell you what’s really happening. They don’t show you which reps are killing margin, which campaigns are quietly failing, or where your […]

In experience curves, the trajectory of cancellations matters more than the final number. For VSC and home warranty marketers, the timing of cancellations drives profitability. Early cancels destroy cash flow—so don’t just track how many. Track when. Why do early cancellations hurt more? If you’re a VSC marketer or home warranty marketer, you know cancellations […]

- 1

- 2