March 2025 Home Sales: Strong Spring Lift, Structural Constraints Remain

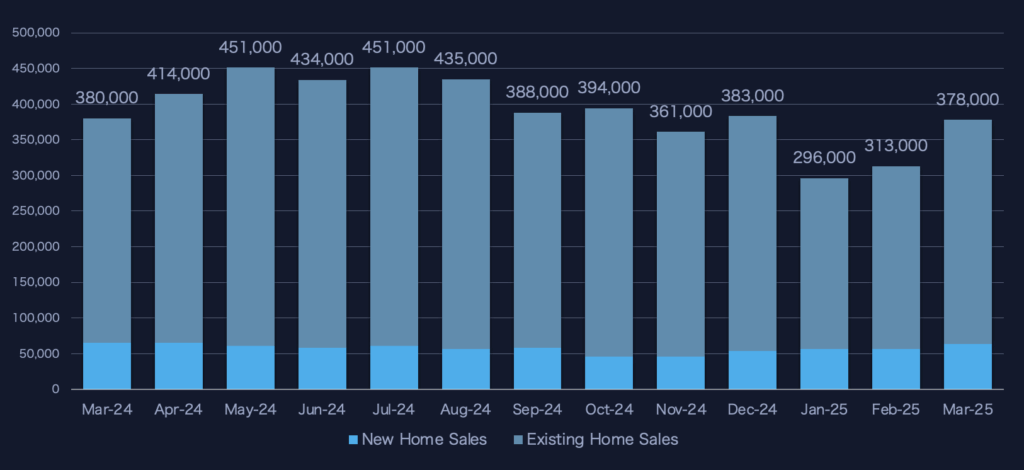

Home sales across the U.S. jumped in March 2025, signaling a typical spring bounce in buyer activity—but that momentum was layered atop a still-fragile foundation. Compared to February, total home sales rose by more than 20%, with gains across both new and existing home categories. However, viewed in the broader context of persistent affordability issues, limited supply, and rising structural headwinds, the March rebound looks more seasonal than structural.

The housing market continues to wrestle with high mortgage rates, low inventory, and affordability pressures. While March’s figures show signs of renewed activity, the underlying conditions haven’t changed enough to suggest a sustained recovery is underway.

A Seasonal Rebound From a Low Base

March brought a significant month-over-month jump in both new and existing home sales. Existing home transactions climbed over 22%, and new home sales rose more than 12%. This surge represents one of the largest single-month increases in recent memory. But it’s important to note that the February baseline was unusually low—one of the weakest months for home sales since early 2020.

The return of seasonal buying patterns played a major role. March typically marks the beginning of the spring selling season, when inventory ticks upward and buyer activity ramps up. Mild weather, more daylight, and increased seller listings often create a natural lift in transactions.

But seasonality doesn’t solve the long-standing challenges holding back the market: elevated borrowing costs, constrained supply, and affordability pressures across nearly every region of the country.

Inventory Remains the Bottleneck

One of the defining features of the current market cycle is the chronic undersupply of homes for sale. Despite a small increase in listings in March, the overall level of available inventory remains well below historical norms. Many homeowners are choosing not to list their properties, unwilling to give up mortgages locked in at 3% in exchange for 6.5–7% financing on a new home.

The result is a market with limited turnover. Even as buyer interest picked up in March, the lack of available homes continues to cap how much activity can truly recover.

Affordability Pressures Continue

While sales volumes improved, affordability did not. Mortgage rates remained elevated throughout the month, and while inflation showed signs of cooling, borrowing costs are still a major barrier for entry-level and mid-market buyers. Home prices did not fall meaningfully in most markets during the first quarter of 2025. Combined with rising insurance costs and property taxes in some states, the total monthly cost of homeownership continues to weigh heavily on prospective buyers.

This affordability squeeze is particularly acute in high-cost states like California and Florida, where prices are still elevated and insurance costs have climbed sharply. Even in more moderately priced states, wage gains have not fully kept up with housing costs.

State-Level Trends

While national trends tell one story, individual state markets continue to reflect a complex set of local drivers—ranging from demographics and taxes to climate and migration.

Texas

Texas remains one of the most active markets in the country. Population growth, a diversified economy, and continued new construction have created one of the few markets where both demand and supply are expanding. Homebuilders have added inventory in response to continued in-migration, and job growth remains strong in major metros like Dallas, Houston, and Austin. March saw a solid increase in closed transactions across all major regions, supported by a relatively healthy labor market and broader economic momentum.

Florida

Florida continues to post strong sales figures, buoyed by in-migration from the Northeast and Midwest. However, the pace of growth has cooled compared to prior years. Insurance premiums have become a defining factor in the state’s housing market, with some homeowners seeing their annual costs triple. That burden, alongside rising property taxes and persistent affordability concerns, has started to temper demand in previously red-hot markets like Naples, Sarasota, and parts of South Florida. Still, population growth and continued retiree interest keep Florida near the top of state sales volume rankings.

California

California’s market remains stagnant. Affordability challenges are among the most severe in the country, and high home prices combined with high mortgage rates have dramatically slowed turnover. In March, there was a modest seasonal uptick in activity, but overall sales remain well below historical norms. Longtime homeowners are staying put, discouraged by the steep increase in monthly payments they’d face on a new home—and by California’s property tax structure, which penalizes turnover. Wildfire risk and tightening insurance availability continue to add to the cost of ownership, especially in inland and high-risk zones.

New York

Sales volumes in New York were up modestly in March, driven in part by activity in suburban and exurban counties. Still, statewide inventory remains historically low. Net outmigration continues to be a drag on long-term demand, particularly in upstate regions, but prices have held firm due to the scarcity of available homes. The New York City metro has regained some buyer activity post-pandemic, but transaction volumes are still subdued compared to pre-2020 levels. Affordability remains a central concern, with high property taxes and overall carrying costs suppressing volume even in higher-income areas.

Illinois

Illinois posted one of the more stable rebounds in March, particularly in the Chicago metro area. While the state continues to experience population loss, the pace of that loss has slowed, and housing turnover picked up in Q1. Illinois stands out as a market with more modest price growth and less volatility—due in part to its high property tax burden and slower economic growth. Prices remain relatively affordable compared to coastal states, and while tax costs are high, insurance rates are more stable. As a result, March brought an uptick in buyer interest, particularly in suburban counties.

Structural Headwinds Haven’t Moved

Despite March’s strong gains, the structural issues plaguing the housing market remain firmly in place.

- Mortgage rates are still hovering around 6.7–7%, which severely limits affordability.

- The housing deficit, estimated at over 4.7 million units, continues to restrict inventory growth.

- Rate lock-in is discouraging homeowners from selling and moving.

- Climate risk and insurance availability are now material factors in housing affordability, especially in Florida and California.

Even as job growth continues and inflation moderates, these factors are keeping housing activity below its historical average.

Year-Over-Year Context

Compared to March 2024, total home sales were nearly flat—down just 0.5%. That near-parity conceals important shifts within the market. New home sales are down year-over-year, reflecting both affordability constraints and a pullback in speculative construction. Existing home sales, on the other hand, held flat versus a year ago, which in this environment represents a form of resilience.

Buyers who can navigate the higher costs are still moving, but the pool of qualified and motivated buyers remains thin. With demand now increasingly sensitive to even small shifts in mortgage rates or inventory availability, the market is likely to remain choppy heading into the second quarter.

Conclusion

March 2025 marked a significant improvement in month-over-month home sales, driven by seasonality, modest inventory growth, and stronger buyer urgency. However, the deeper issues affecting the housing market—affordability, constrained supply, rate lock-in, and climate risk—remain unresolved. Until those fundamentals shift, any sustained recovery in home sales volume is likely to be incremental, regionally uneven, and vulnerable to setbacks.

While the March data is encouraging, it’s more of a short-term lift than a long-term breakout.

Find our other home sales recaps here.