Home Sales October 2025: Builders Move, Owners Wait

Reflecting the most recent U.S. Census Bureau release (October 2025) Published January 2026

The U.S. housing market operated under competing constraints in October 2025. Buyer demand remained rate-sensitive and affordability-limited, while resale supply continued to be constrained by homeowner lock-in. Builders, however, adapted more quickly—using pricing flexibility and incentives to sustain transaction flow.

October 2025 data reinforced a pattern that defined much of the past year: housing activity was not frozen, but it was uneven. New and existing home markets behaved differently, and that divergence continued to determine where transactions actually closed.

October 2025 Home Sales at a Glance: Two Markets, Two Realities

| Metric | New Homes | Existing Homes |

|---|---|---|

| SAAR Sales Volume | 737,000 | 4.10 million |

| Estimated Monthly Closings | ~61,000 | ~342,000 |

| Median Sale Price | $392,300 | $415,200 |

| YoY Price Change | –8.0% | +2.1% |

| Inventory | ~488,000 | ~1.52 million |

| Months of Supply | ~7.9 months | ~4.4 months |

Why it mattered:

Builders continued to manage sales velocity through incentives and pricing adjustments, while existing-home transactions remained constrained by limited resale inventory and rate lock-in. This imbalance shaped where volume—and downstream attach opportunity—existed.

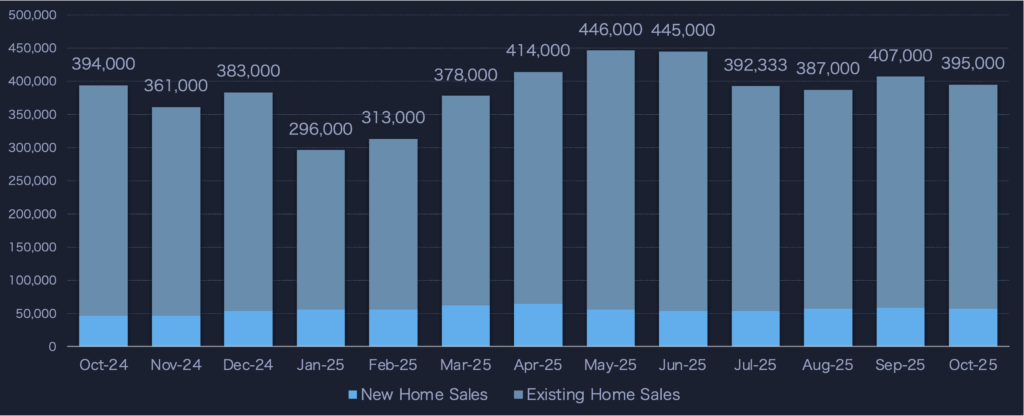

New vs. Existing Home Sales Volume (12-Month View)

New Home Sales: Builders Sustained Activity

According to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, new home sales activity in October was supported by elevated inventory levels and continued use of builder incentives.

While demand cooled relative to earlier cycles, builders retained the flexibility to adjust pricing, offer mortgage rate buydowns, and provide closing-cost assistance—allowing them to maintain transaction flow despite restrictive financing conditions.

New Home Pricing

Median new-home prices declined year-over-year in October, reflecting a combination of:

- Targeted price reductions

- Incentive-driven sales

- Shifts toward smaller or more affordable product

This pricing flexibility allowed new construction to compete more directly with resale homes than is typical at this stage of the cycle.

Existing Home Sales: Incremental Improvement, Structural Limits

Data from the National Association of REALTORS® and Federal Reserve Economic Data showed that existing home sales improved modestly in October but remained well below long-term norms.

Mortgage rates eased slightly during the month, supporting buyer interest at the margin. However, resale inventory remained constrained as homeowners with low-rate mortgages continued to delay selling.

Existing Home Pricing

Despite lower transaction volume, existing-home prices remained relatively firm. Limited supply continued to provide price support, offsetting affordability pressures that would otherwise have weighed more heavily on valuations.

This stood in contrast to the greater pricing flexibility observed in new construction.

New vs. Existing: Structural Differences Persisted

| Metric | New Homes | Existing Homes |

|---|---|---|

| Share of Monthly Sales | ~15% | ~85% |

| Pricing Flexibility | High | Low |

| Inventory Conditions | Elevated | Constrained |

| Buyer Rate Sensitivity | Moderate | High |

| Transaction Control | Builder-managed | Owner-limited |

While resale homes continued to account for the majority of transactions, new construction played an outsized role in sustaining deal flow—particularly in higher-inventory regions.

Regional Trends: October 2025 Update

| Region | Inventory YoY | Price Trend YoY | Days on Market (Trend) |

|---|---|---|---|

| West | +17.4% | Slight softening | Higher |

| South | +17.0% | Modest softening | Higher |

| Midwest | +12.2% | Flat to modest gains | Higher |

| Northeast | +8.9% | Flat to modest gains | Higher |

What changed from earlier in 2025:

Inventory growth remained positive across all regions, but the pace of expansion slowed in October. Homes took longer to sell nationally, while pricing pressure was strongest in regions where inventory had risen the most.

Market Implications Heading Into Year-End

As 2025 approached its close, the housing market remained defined by imbalance rather than momentum. Slightly lower mortgage rates helped stabilize activity, but not enough to unlock a broad resale recovery.

For organizations tied to housing transactions, the takeaway remains consistent: opportunity continues to skew toward builder-driven volume and resale-light regions where transactions are actually occurring. For additional historical context, see Dark Sky Data’s prior coverage of housing transaction trends in our Home Sales archive.

What to Do Now: Channel Playbooks (Data-Aligned)

If You Market Direct-to-Consumer (DTC)

- Focus on metros with rising inventory and longer days on market

- Target builder buyers and price-sensitive move-ups

- Frame messaging around budget certainty and post-purchase protection

If You Work With Real Estate Agents

- Prioritize Midwest and Northeast markets where inventory remains tight

- Position warranties as offer-strength tools or seller-paid differentiators

- Support agents with pricing-pressure and inspection-risk messaging

If You Partner With Builders

- Bundle warranties with closing incentives and mortgage buydowns

- Position coverage as part of affordability, not an add-on

- Focus on higher-inventory communities where incentives are already in use

Data Sources

This analysis draws on October 2025 data from:

- U.S. Census Bureau & U.S. Department of Housing and Urban Development — New Residential Sales Report

- National Association of REALTORS® — Existing Home Sales Report

- Federal Reserve Economic Data — Existing Home Sales Tables

- Redfin, Zillow, Realtor.com, Florida Realtors, California Association of REALTORS®, Texas Real Estate Research Center, and regional MLS data

About Dark Sky Data

Dark Sky Data provides housing, economic, and property intelligence designed to help home warranty providers, administrators, and real estate professionals anticipate demand and allocate resources with confidence.